The restriction of mat credit from the income tax payble u s 115baa by the circular dated 02 10 2019 thus ultra vires the act and it is a settled legal principle that a circular cannot override the provisions of the act.

Mat credit entitlement accounting.

If a company has mat credit of rs.

How the mat credit was created originally in the books of accounts.

20 it is also to be carefully seen that any mat credit previously recognized is to be further maintained or not.

10 lakh while that as per the.

Loans and advances shows mat credit amounting to rs.

According to paragraph 6 of accounting standards interpretation asi 6 accounting for taxes on income in the context of section 115jb of the income tax act 1961 issued by the institute of.

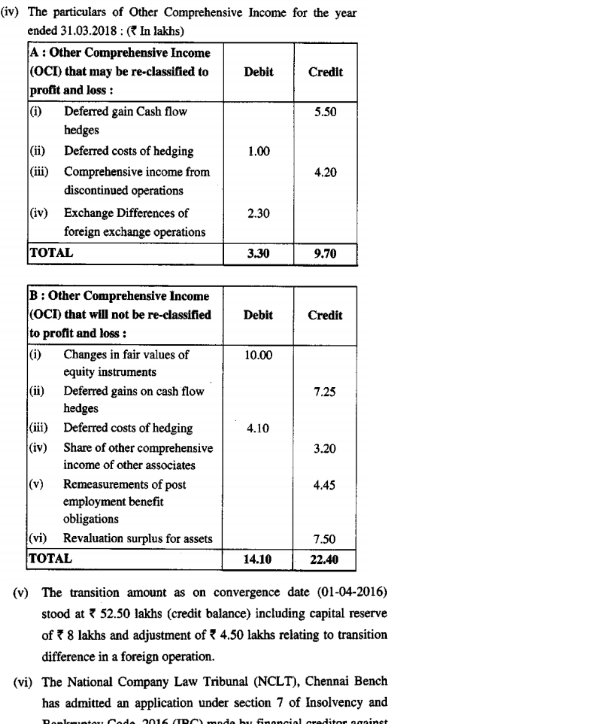

To statement of profit or loss being mat credit entitlement recognised for the year hence the following presentation was made in the as complaint financial statements.

1 lakh the tax liability as per the normal provisions for fy 2019 20 is rs.

In the statement of profit.

A tax credit scheme is introduced by which mat paid can be carried forward for set off against regular tax payable during the subsequent fifteen years period subject to certain conditions as under.

This depends on whether the company believes whether or not it will be able to pay normal tax and utilize the credit before it expires.

A in the year of creation.

The unavailed amount of mat credit entitlement if any should continue to be presented under the head loans advances.

The difference arising out of mat paid and mat credit entitlement can be treated as tax paid during the year.

The committee takes a note of guidance note on accounting for credit available in respect of minimum alternative tax under the income tax act 1961 and is of the opinion that mat credit entitlement should be recognised in the books of the company if there exists convincing evidence that the company would be able to avail the future economic benefits arising therefrom during.

The maximum amount of mat credit that you can claim cannot exceed the difference between the normal tax liability and the mat liability in the year for which the mat credit is being availed.

It is imperative to have an express provision in the law to forbid a benefit already given under a law which is absent in this case.

Profit loss account.

An issue has been raised whether the mat credit can be considered as a deferred tax asset within the meaning of accounting standard as 22 accounting for taxes on income issued by the institute of chartered accountants.

To mat credit entitlement account.

When it was indian gaap.

For accounting entries relating to reversal.

Accounting treatment whether mat credit is a deferred tax asset 4.

It must also be noted that deferred tax charge is not covered by any other clause of the explanation to section 115jb 2 and is therefore not required to be added back in the computation of book.